February is coming in hot. Or rather… not hot at all. 🏖

My wife and I have spent the last few nights doing what every Northwest Ohio household does this time of year: aggressively scrolling vacation destinations as if warmth itself might sell out by midnight. February in this region has a way of testing resolve. The holidays are behind us, the daylight is rationed, and spring still feels like a rumor. Suggestions for thaw-out destinations are officially welcome.

Meanwhile, our neighbors packed up and headed to Naples until April; with an open invite. Which, beyond triggering mild envy, was also a good reminder that life is lived in chapters. We’re currently deep in ours: one toddler, one four-month-old, and a steady rotation of coffee, diapers, and optimism. We’re lucky to be surrounded by people in all different stages of life; many of whom are quick to remind us how fast this one goes, and how good it is.

So yes, the weather is doing its thing. But underneath the gray skies, something else is happening. Opportunity is quietly knocking on Northwest Ohio’s door; financially, economically, and professionally. Capital is moving, companies are building, and careers are being shaped here in ways that don’t always make headlines but matter all the same.

And to those who are new here, welcome! We’ve grown roughly 20% over the last month, thanks in large part to readers who keep sharing this with colleagues, friends, and family. This is a weekly note for people building careers, companies, and wealth in Northwest Ohio; no noise, no agenda, just the details that matter.

Let’s get into it.

💪 This Week’s Shoutout: Jacob Wethington, Senior Manager at Blue & Co.

Jacob has been with Toledo Money since week one; and more impressively, hasn’t missed a single edition. That kind of consistency doesn’t happen by accident.

He brings deep experience in healthcare reimbursement and consulting, an area where nuance matters and expertise is hard-earned. It’s exactly the type of perspective that strengthens this community; people who understand complex systems, think long-term, and care about how decisions ripple through organizations and families.

We’re grateful Jacob chose to build his career here and raise his family in Northwest Ohio. Readers like him are a big part of why this platform works.

Local Stock Market | 📈

Owens Corning | $OC ( ▼ 0.17% )

Dana Incorporated | $DAN ( ▼ 1.5% )

The Andersons | $ANDE ( ▲ 0.14% )

Owens Illinois | $OI ( ▲ 2.13% )

Welltower Inc. | $WELL ( ▼ 0.64% )

Marathon Petroleum Corporation | $MPC ( ▼ 1.42% )

First Solar | $FSLR ( ▼ 1.45% )

Get the investor view on AI in customer experience

Customer experience is undergoing a seismic shift, and Gladly is leading the charge with The Gladly Brief.

It’s a monthly breakdown of market insights, brand data, and investor-level analysis on how AI and CX are converging.

Learn why short-term cost plays are eroding lifetime value, and how Gladly’s approach is creating compounding returns for brands and investors alike.

Join the readership of founders, analysts, and operators tracking the next phase of CX innovation.

A 60-Mile Gap That Changes the Deal

Two markets. One region. Opposite investor profiles.

Detroit and Toledo are close enough to share headlines, labour flows and manufacturing tailwinds. But in multifamily, they are not competing with each other. They are serving different buyers entirely.

Start with pricing.

Detroit assets are trading around $112,000 per unit at roughly a 7.2% cap.

Toledo trades closer to $62,000 per unit at a 9.7% cap.

That gap alone tells you what kind of capital is in each market. You might assume Detroit is also winning on rent growth. It isn’t. Toledo rents are growing around 2.0% annually, compared to 1.3% in Detroit. Both are well ahead of the national average and both are operating with sub-8% vacancy. The difference is why.

Detroit is priced for what it might become

Detroit’s multifamily market is no longer about cash flow. It’s about positioning.

Buyers are underwriting long-term upside tied to EV manufacturing, university-led research and a broader re-industrialisation thesis. That future is already in the price.

Recent trades reinforce that. Waterfront and close-in suburban assets are selling well above their last cycle bases. Downtown absorption has been strong, but yields continue to compress as institutional groups compete for scale and narrative. When you see national capital clustering in one market, it’s usually because they all believe the same story. Detroit has that story right now. The risk isn’t demand. The risk is paying tomorrow’s price today.

Toledo is still a working market

Toledo does not have a national narrative. That is exactly why it still works. Deals here are being bought on current income, not five-year projections. Cap rates remain high because competition is limited and institutions are not active in size. Properties trade because they cash flow, not because they fit a fund thesis.

And yet, the fundamentals are quietly strengthening.

Northwest Ohio just landed the largest manufacturing investment in its history. That capital brings jobs, suppliers and wage pressure. Housing demand follows. Pricing has not. Transaction volume tells the story clearly. Detroit saw hundreds of millions trade last year. Toledo barely crossed eight figures. That is not stagnation. That is under-the-radar.

Supply matters, but timing matters more

Detroit’s strongest submarkets have limited new supply coming. That should support rent growth, particularly as absorption continues downtown and in adjacent nodes.

Toledo has new units planned, but most deliveries are still years away. In the meantime, existing properties are operating in a market that rewards good management. Operators who know the tenant base are maintaining high occupancy and steady rent increases without stretching affordability.

The real decision

This isn’t about which market is “better”. It’s about what you are trying to achieve. If you want appreciation and are comfortable with compressed yields, Detroit makes sense. If you want cash flow, margin of safety and a low basis, Toledo remains compelling, especially before industrial growth is fully reflected in pricing.

Toledo will not make national headlines. It does not need to. Investors who have been operating here for decades know exactly what it is: a market that rewards patience, discipline and local knowledge.

The Midwest is not one trade anymore.

It’s multiple strategies, sitting an hour apart.

That’s where opportunity still hides.

Hot Take: When Affordability Becomes the Headline

This week, Toledo stepped into rare air.

According to Zillow, Toledo is now the most popular large city in the country and the #5 most popular real estate market overall. In a national housing market defined by anxiety, sticker shock, and shrinking options, Northwest Ohio suddenly looks functional (and more importantly, affordable).

And that is exactly why this moment deserves a closer look.

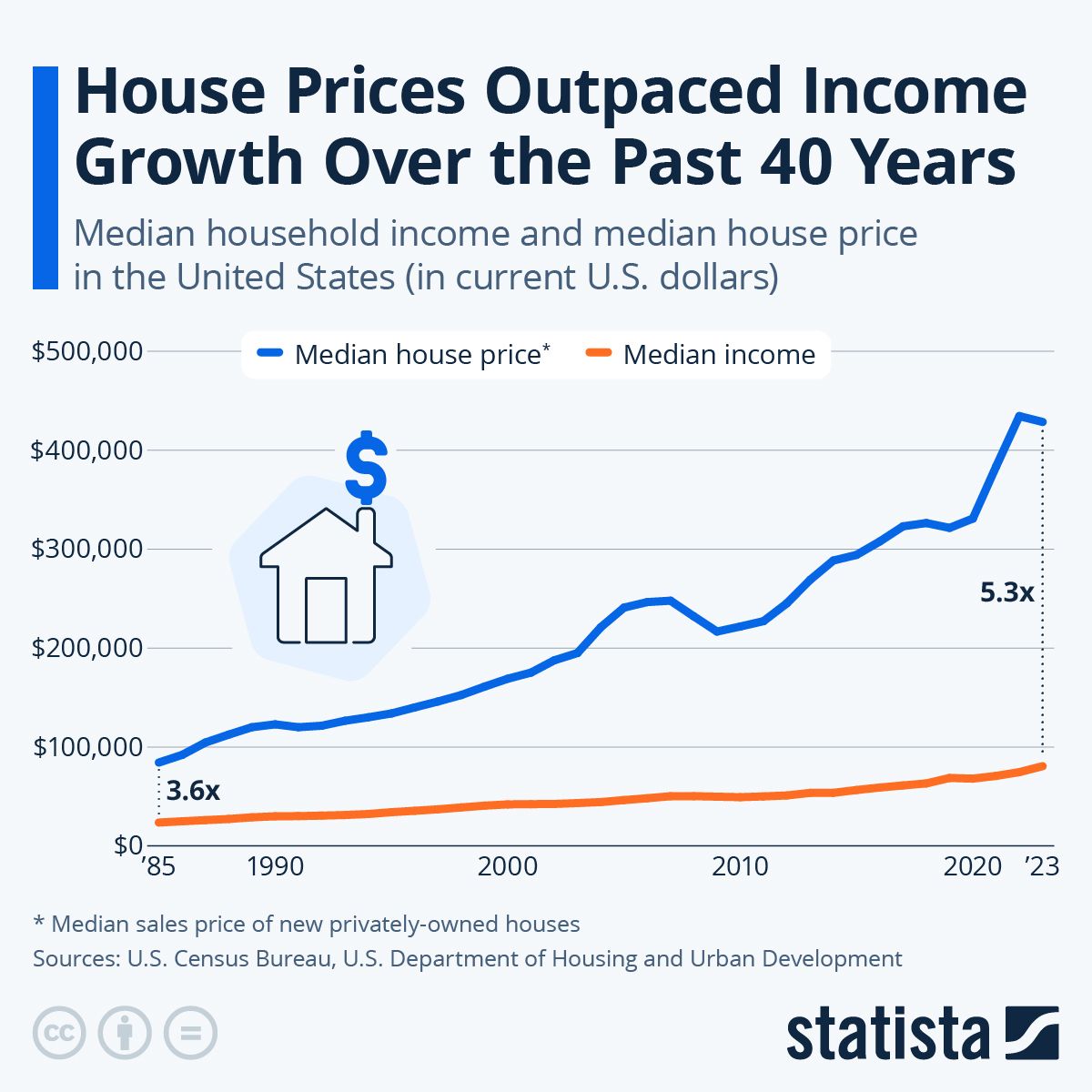

Toledo has never led the country in wage growth. In fact, the data tells a more sobering story. Median household income in Toledo sits around $47,500, compared to roughly $78,500 nationally. That gap is not new but it matters more now than it ever has.

What has worked in our favor is affordability. The median home value in Toledo is roughly $130,000, versus a national median north of $400,000. That delta is massive. It is why first time buyers can still buy here. It is why families can trade up without taking on generational debt. And it is exactly why Toledo is climbing national rankings.

But affordability does not exist in a vacuum.

As housing demand rises, especially from buyers relocating from higher cost metros, the math changes quickly. If wages do not rise in parallel, the same neighborhoods that have long been safe, stable, and attainable for locals become harder to access. Not overnight. But steadily.

This is where the conversation gets uncomfortable and necessary.

There is always a slice of bad that comes with the good. When affordability becomes a national headline, local buyers are suddenly competing in a market shaped by outside incomes, remote work salaries, and investor interest. Without stronger wage growth, Toledo risks pricing out the very people who made the market attractive in the first place.

That is why economic development strategy matters more now than it did five years ago.

Leaders like Dean Monske and the team at the Regional Growth Partnership have increasingly focused on attracting white collar roles to Northwest Ohio. Roles that drive wage growth, career mobility, and long term economic resilience. This is not about abandoning manufacturing or logistics. Those sectors remain foundational and honorable. But they alone do not scale incomes fast enough to keep pace with national trends.

The data reinforces that reality.

Only about 21% of Toledo residents hold a bachelor’s degree or higher, well below many peer metros. Research also shows that Ohio, and Northwest Ohio in particular, loses a disproportionate share of residents with advanced degrees. That is the brain drain leaders talk about, and it is not abstract.

Young professionals chasing careers in tech, finance, consulting, and high growth sales often leave not because they want to but because the opportunities are not here yet. Chicago, Columbus, and Cincinnati continue to absorb that early career talent.

If Toledo wants to remain affordable and livable for the people who already call it home, housing momentum must be matched with job momentum. White collar roles are not a nice to have. They are the mechanism that allows wages to rise alongside demand.

Popularity is a gift.

But only if we are prepared for what comes next.

The real test for Northwest Ohio is not whether people want to move here. That question is already answered.

The test is whether we can grow wages, careers, and opportunity fast enough to make sure the people who built this place are not left watching from the sidelines.

That is the chapter we are entering now.

💵 Money Snacks

Here are a few headlines we are snacking on

Detroit’s comeback is pushing east. Anyone who has been up Woodward Avenue recently has seen the scale of reinvestment. New retail, restaurants, foot traffic and momentum. Now Dan Gilbert is turning his attention to the RenCen corridor, the riverfront stretch between the former GM towers and the MacArthur Bridge. The bet is long term. Gilbert’s team believes this area can be reshaped over the next decade into a new economic spine for downtown Detroit. It is another reminder that waterfronts are not amenities, they are growth engines. Which raises the question closer to home. How does Northwest Ohio unlock its own waterfront potential?

Ten to fifteen years ago, a new family-sized SUV was still considered a middle-class purchase. Today, it’s creeping toward luxury pricing.

Then (around 2010):

Toyota Highlander: ~$30,000 base

Honda Pilot: ~$30,000 base

A typical three-row family SUV started in the low $30ks, roughly in line with the average new vehicle price at the time.

Now (2025 models):

Toyota Highlander: ~$39,500+

Honda Pilot: ~$40,000+

Larger family SUVs (Tahoe, Expedition, Suburban): $53,000–$61,000+ base

That’s a ~30–35% jump for mainstream family SUVs — before options, taxes, or financing.

The bigger picture:

The average new vehicle in the U.S. now sells for $45,000+.

Full-size SUVs routinely transact far above their base price, often landing near $70,000+.

Bottom line:

What used to be a practical family upgrade has quietly become a high-ticket purchase. For many households, the “normal” family SUV now carries a luxury-car payment.

Northwest Ohio Business Radar

Which best describes your housing strategy right now?

📬 Forward Thinking

We’re not just building a newsletter—we’re building a clubhouse for ambitious professionals who care about Toledo’s economic future (and their own place in it).

If you know a colleague, peer, or friend who should be part of this circle, pass this along. The more sharp minds we bring to the table, the stronger our region grows.