Friday’s here, even if it feels like winter is doing its worst to pretend otherwise. When the wind chill is pushing minus 25, optimism does not come easily. But moments like this tend to sharpen focus.

This week, we came across a sharply written opinion piece expressing deep frustration with the state of economic progress in the City of Toledo. Many of the critiques will sound familiar to anyone building a career, a company, or wealth in northwest Ohio. They certainly did to us.

Where we differ is what comes next. Pointing out what is broken is easy. What matters is identifying how change actually happens and how it can succeed. At Toledo Money, we care more about execution. The reality is this: meaningful growth in Toledo is possible, but only if private capital is organized, invited, and put to work with intention.

Below, we break down what that looks like in practical terms and where the opportunity truly sits.

Let’s get into it.

💪 This Week’s Shoutout: Michael Vanderpool, He’s the host of the Make It Happen podcast, an Assistant Professor at Defiance College, and the founder of Anthony Wayne Innovation and Design; plus a steady advocate for economic growth across NW Ohio. Michael leads from the front, every day. Thanks for supporting Toledo Money.

P.S. Keep an eye out for a Toledo Money mug on the Make It Happen podcast.

Local Stock Market | 📈

Owens Corning | $OC ( ▲ 2.96% )

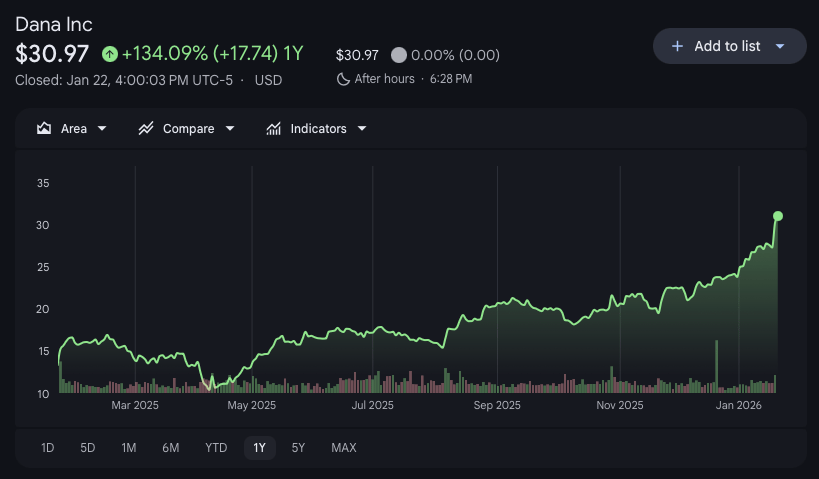

Dana Incorporated | $DAN ( ▲ 2.3% )

The Andersons | $ANDE ( ▲ 1.44% )

Owens Illinois | $OI ( ▲ 0.49% )

Welltower Inc. | $WELL ( ▲ 1.34% )

Marathon Petroleum Corporation | $MPC ( ▲ 3.72% )

First Solar | $FSLR ( ▼ 6.84% )

Maumee’s Quiet power Move | The Reset That Comes With Little Margin for Error

On paper, Dana Incorporated just delivered one of the more impressive operational resets we’ve seen out of a legacy industrial company in years.

But Wall Street isn’t throwing a parade yet… and the reason is leverage.

The Bull Case Is Clear

Dana exited 2025 after doing most of the hard, unglamorous work:

Sold its Off-Highway business for $2.7B

Delivered $250M in cost savings (now targeting $325M)

Returned $704M to shareholders

Repurchased 23% of shares outstanding

Entered 2026 guiding to 10–11% EBITDA margins, up meaningfully from prior years

This is the part management wants investors focused on: a slimmer portfolio, higher-margin contracts, and a $750M three-year new business backlog ~$200M of which hits in 2026.

Where the Skeptics Live

The hesitation isn’t about execution so far. It’s about balance sheet math.

Even after paying down roughly $1.9B in debt, Dana is still a leveraged business with:

Only a few hundred million dollars in cash on hand

Total debt that remains multiple turns of EBITDA

Exposure to a cyclical auto production environment

That combination explains why some analysts remain neutral despite improving margins. Dana doesn’t have the luxury of a prolonged downturn, a messy OEM cycle, or a stumble in cost execution. The company has less financial cushion than peers with lighter debt loads.

In other words: this is a company that needs the plan to keep working.

Why Debt Reduction Is the Real Story

Strip away the headlines, and Dana’s real priority for 2026 is simple:

De-leveraging before the cycle turns.

Management has been explicit that proceeds from asset sales and operating improvements are being used to strengthen the balance sheet — not chase growth for growth’s sake. That’s why flat revenue with higher margins is being celebrated internally.

For investors, this is a “prove it” phase:

Can Dana sustain 10%+ margins through a normal auto cycle?

Can it continue paying down debt while funding shareholder returns?

Can new business wins offset pricing pressure from OEMs?

Why This Still Matters for Northwest Ohio

Here’s the local takeaway that gets lost in earnings calls:

Dana is choosing discipline over expansion; and doing it while staying headquartered in Maumee.

That signals:

Long-term confidence in its core businesses

A commitment to high-skill, higher-margin work

Fewer distractions and more predictable operations

This isn’t a company chasing headlines or flashy growth narratives. It’s a company trying to earn its valuation back the hard way.

Toledo Money Take

Dana’s reset is real and so is the scrutiny.

The company has bought itself credibility with execution. Now it needs to buy flexibility with debt reduction. If margins hold and leverage keeps coming down, the skepticism fades fast. If not, the balance sheet will remain the limiting factor.

Either way, this is one of the most important companies to watch in Northwest Ohio in 2026; not because it’s flashy, but because it’s focused on execution.

📞 The Open Line

We are opening up a community-driven feed for the Toledo region.

This is where readers can share what they’re seeing inside their industries: early signals, quiet moves, inside scoops, or loose threads worth pulling. Sometimes it’s simple curiosity. Other times it turns into real reporting.

That’s exactly how our recent look at the Gordie Howe Bridge started. A reader reached out with a question; what’s real, what’s speculation, and what does it actually mean locally. We did the research, followed the trail, and published the story.

That’s the model.

If you’re hearing something, wondering something, or think a topic deserves a closer look, give us a holler. You don’t need the full story; just enough to point us in the right direction. We’ll take it from there.

Unsolicited Opinion: If Toledo is the Product, We are Bad Marketers.

Downtown Toledo Library

When people talk about “Toledo” needing major investment, what they usually mean is the city proper. Yet in most conversations with people who do not live around here, Toledo refers to the broader northwest Ohio region: Sylvania, Holland, Maumee, Monclova, Whitehouse, Waterville, Bowling Green, Oregon, Ottawa Hills. In those places, growth is visible and accelerating. New neighborhoods are rising, restaurants are multiplying, businesses are opening and surviving, families are putting down roots.

The contrast is striking. If the region is growing, why does capital keep stopping at the city limits?

Part of the answer is narrative. Large regional media consistently frame Toledo proper as a place defined by decline. Opportunity is rarely centered. Momentum is treated as the exception. Capital follows signals, and the signal being sent is clear. If Toledo is the product, it is being marketed in a way that repels buyers rather than attracts them.

But narrative alone is not the core problem. The deeper issue is that private capital has not been intentionally organized, invited, or structured to invest in the city.

If Toledo proper wants outside capital to move back in, it has to operate the way investable cities do. That means being explicit about where capital fits, how risk is shared, and what success looks like. There are four practical levers that matter in my opinion:

First: Seed and early-stage investment.

Downtown Toledo lacks a visible venture and angel investment pipeline. Outside investors see no deal flow and move on. The fix is straightforward. Create a Toledo-focused angel network made up of local high-net-worth individuals, alumni, and business owners willing to make small, frequent investments in early-stage companies. Pair private capital with limited city co-investment or tax incentives to reduce early risk. Fund two or three high-visibility startup pilots downtown and let success do the signaling. Capital does not follow hope. It follows proof.

Second: Real estate and mixed-use development.

Developers choose the suburbs because risk is clearer and execution is predictable. Toledo can change that by structuring small-scale co-investment vehicles that allow multiple investors to share risk on downtown housing, retail, and adaptive reuse projects. Pick one or two blocks and execute them exceptionally well. Successful streets market themselves far better than planning documents ever will.

Third: Corporate and institutional capital deployment.

Major employers in the region continue to expand outside the city because it is easier, not because the city lacks potential. Corporate venture partnerships, downtown innovation hubs, and employee-linked investments in housing or training can redirect a portion of that capital inward. When companies invest where their talent lives, capital compounds locally.

Fourth: Narrative and information as capital.

Investors avoid what they do not understand. Toledo needs a clear, factual capital playbook that maps opportunity zones, incentives, successful case studies, and the people who can execute. Pair that with small, curated investor roundtables held downtown and publicize outcomes, not aspirations. When information improves, perception follows.

None of these ideas are theoretical. They are standard practice in cities that compete for capital and win.

The money is already flowing into northwest Ohio. Toledo’s challenge is not scarcity. It is structure, signaling, and leadership. If the city wants private capital, it must stop asking for belief and start offering opportunity that capital recognizes.

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

💵 Money Snacks

Here are a few headlines we are snacking on

A quick reminder: we flagged this one before they ever broke ground. A new Chipotle and Tropical Smoothie are opening near Flying Joe in Perrysburg, with what appears to be a drive-through or pickup window. Convenience-driven retail is still the play, especially in NW Ohio winters. For the full background, check our earlier reporting

Keep an eye on Dussel. As we noted earlier, the Seven Brew coffee shop there is nearing its late winter or early spring opening. This marks the second Seven Brew location in NW Ohio, both owned by the same franchisee, and another signal that drive-thru coffee demand isn’t slowing.

Luxury retail just cracked. Saks Global filed for bankruptcy less than a year after its merger, now buried under $3.4B in debt as luxury spending slowed and vendors pulled inventory. Stores will stay open for now, but closures are coming. The takeaway is blunt: this isn’t a one-off failure—it’s confirmation that the luxury department store model is structurally broken. Scale didn’t save Barneys, Lord & Taylor, or Saks.

Another restaurant retrofit to watch. Twin Hospitality Group, a subsidiary of $FAT ( ▲ 6.3% ) Brands, is converting roughly 19 underperforming Smokey Bones locations into Twin Peaks; a move driven by economics, not nostalgia. Twin Peaks units average ~$7.8M in annual sales, more than double Smokey Bones’ ~$3.5M, making retrofits far cheaper and faster than ground-up builds…The first retro-fit in the Toledo area… on Dussel Dr. in Maumee, OH - shout out to Lyle for the intel!

When was the last time you reviewed your personal insurance coverage?

📬 Forward Thinking

Our referral program exists for one simple reason: to make sure as many business professionals in Toledo as possible are speaking the same language.

Toledo Money is designed to raise the collective floor; shared context around finance, economics, deals, hiring, and the forces shaping this region. The more people reading it, the sharper the conversations become. At work. Over coffee. At dinner. In rooms where decisions actually get made.

So here’s the trade…

Refer a few friends who should be reading Toledo Money. When they subscribe (25 verified subscribers), you get rewarded; with gift cards to local restaurants and coffee spots that elevate your regular rotation. The kind of places you already recommend without being asked.

Same signal. Bigger network. Better meals along the way.